Making Informed Decisions: Interest Rates, Inventory, and the Resilience of Real Estate Prices

“Some were expecting an increase in supply combined with a decrease in demand to result in price declines, which the data hasn't shown.”

- MNAR news

Fall Recap:

We can't believe it's almost November! This fall has been flying by, and we've enjoyed all the fall festivals, apple orchards, and pumpkin patches that one can handle. As we continue into the fall real estate market, we've seen some successful wins for our buyers despite the rising interest rates. We did encounter multiple offers again in September and October but managed to secure a home inspection and price reduction during the negotiation phase. We also had buyers who took advantage of a unique property that had been sitting on beautiful lake frontage for a few weeks and were successful in getting the price they wanted. We like to share these success stories with others so our readers have a better understanding of what's really happening in the Minnesota real estate market.

Today, we see that buyers have a chance to not rush their buying decisions as quickly as before. However, if a home is priced right, in great condition, and located in a sought-after area, it's not uncommon for sellers to have the upper hand. Looking at homes in the fall and winter could favor buyers due to reduced competition, despite the higher rates. At the end of the day, it might not be the right time for everyone to buy and sell, but homes are still selling, and people will always have to make life decisions, which causes buyers to buy and sellers to sell. If the headlines make you nervous or world events are bothering you, we completely understand the feeling of uncertainty. However, if it's any indication, we just purchased another home last month and plan to continue buying homes if the numbers, location, and condition make sense for us, as we analyze the data to make informed decisions and not let the world's headlines dictate our next move. Take a look at the most recent data report from MNR below.

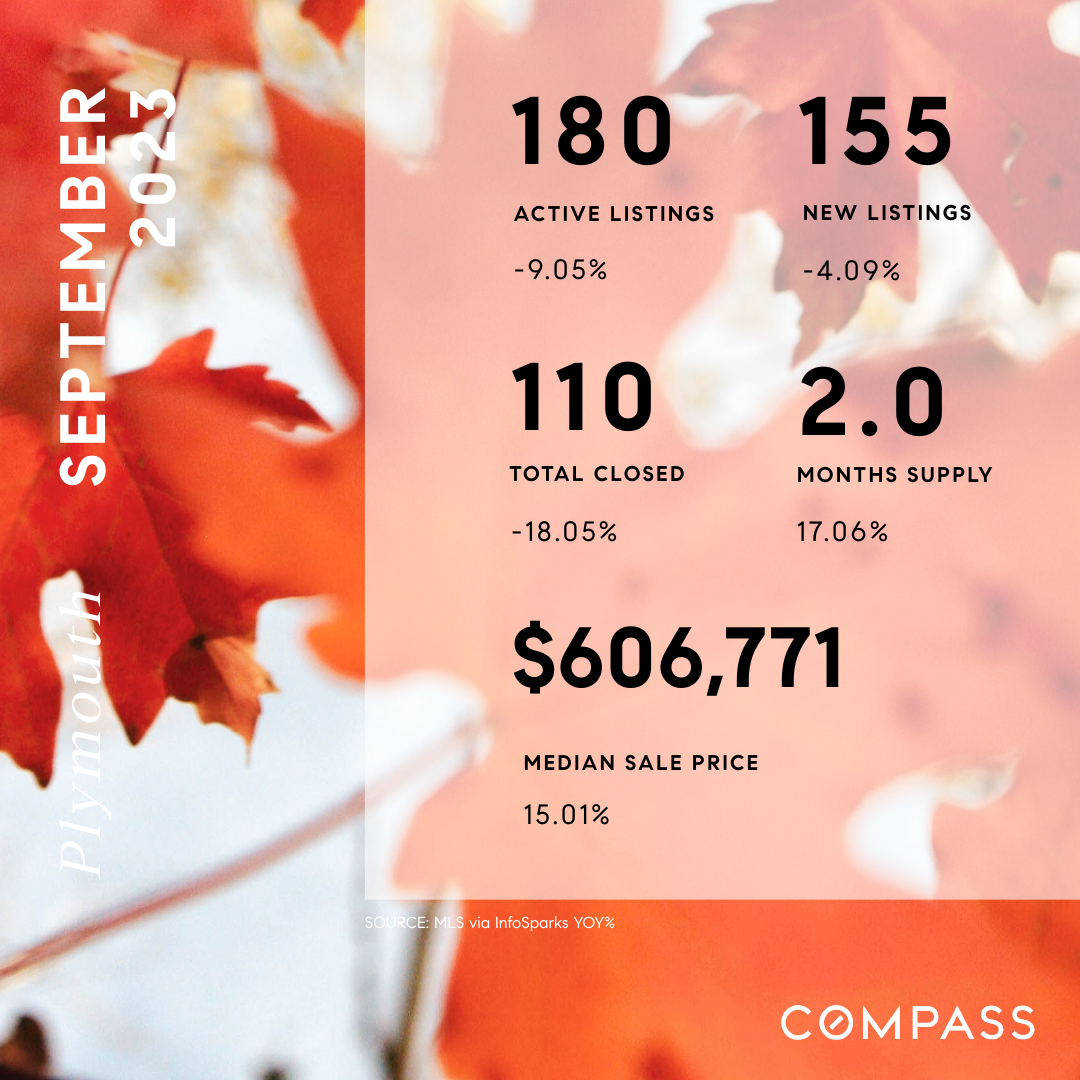

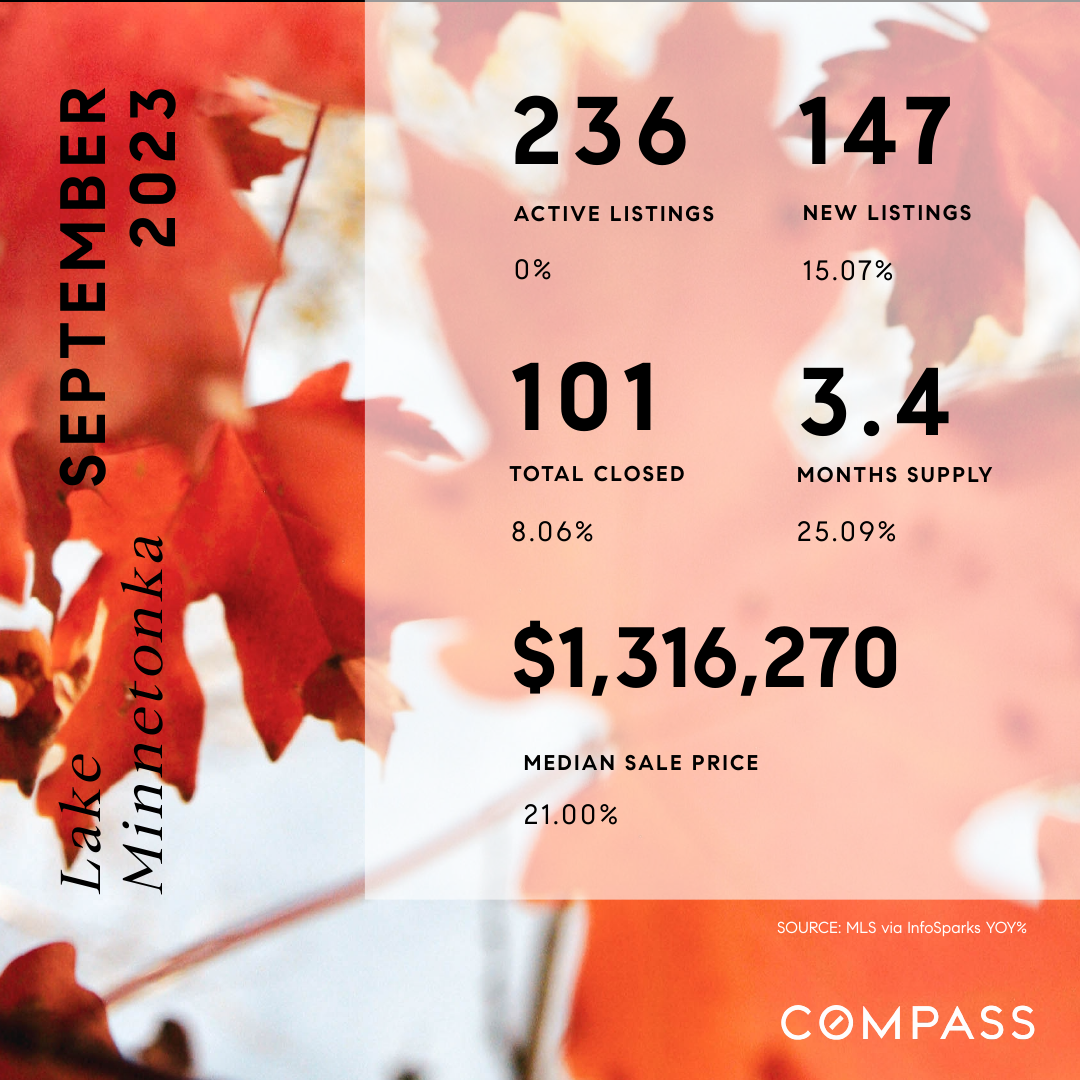

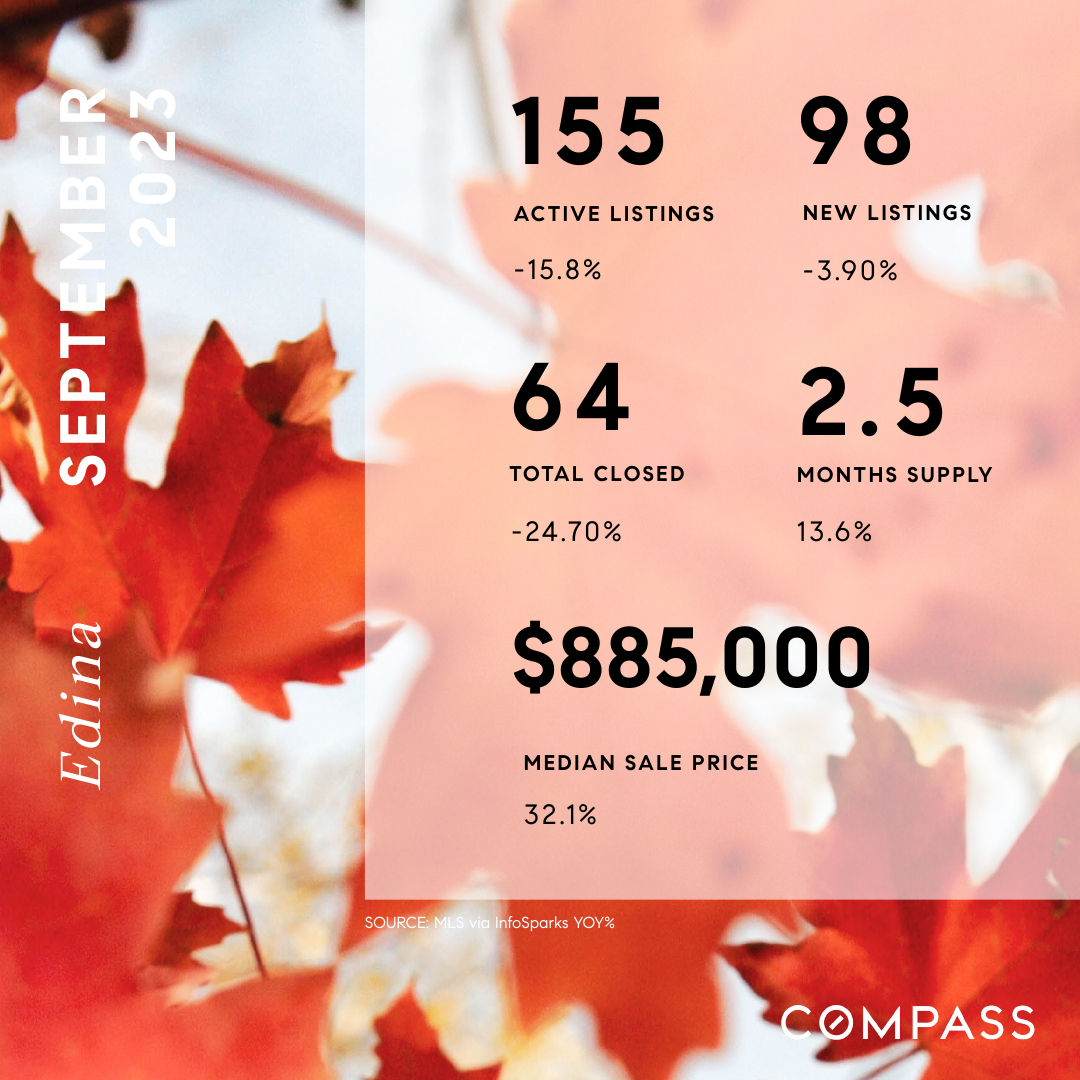

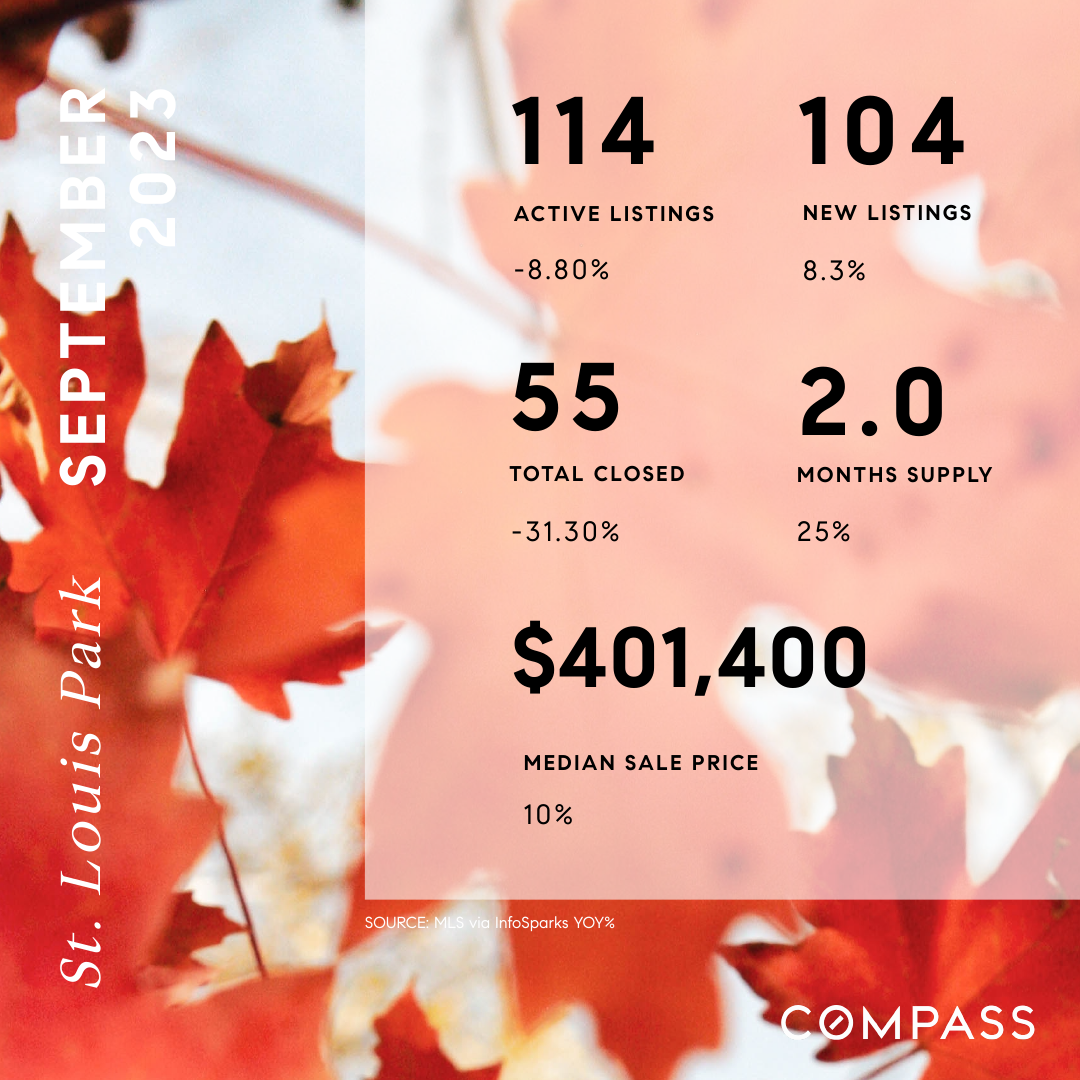

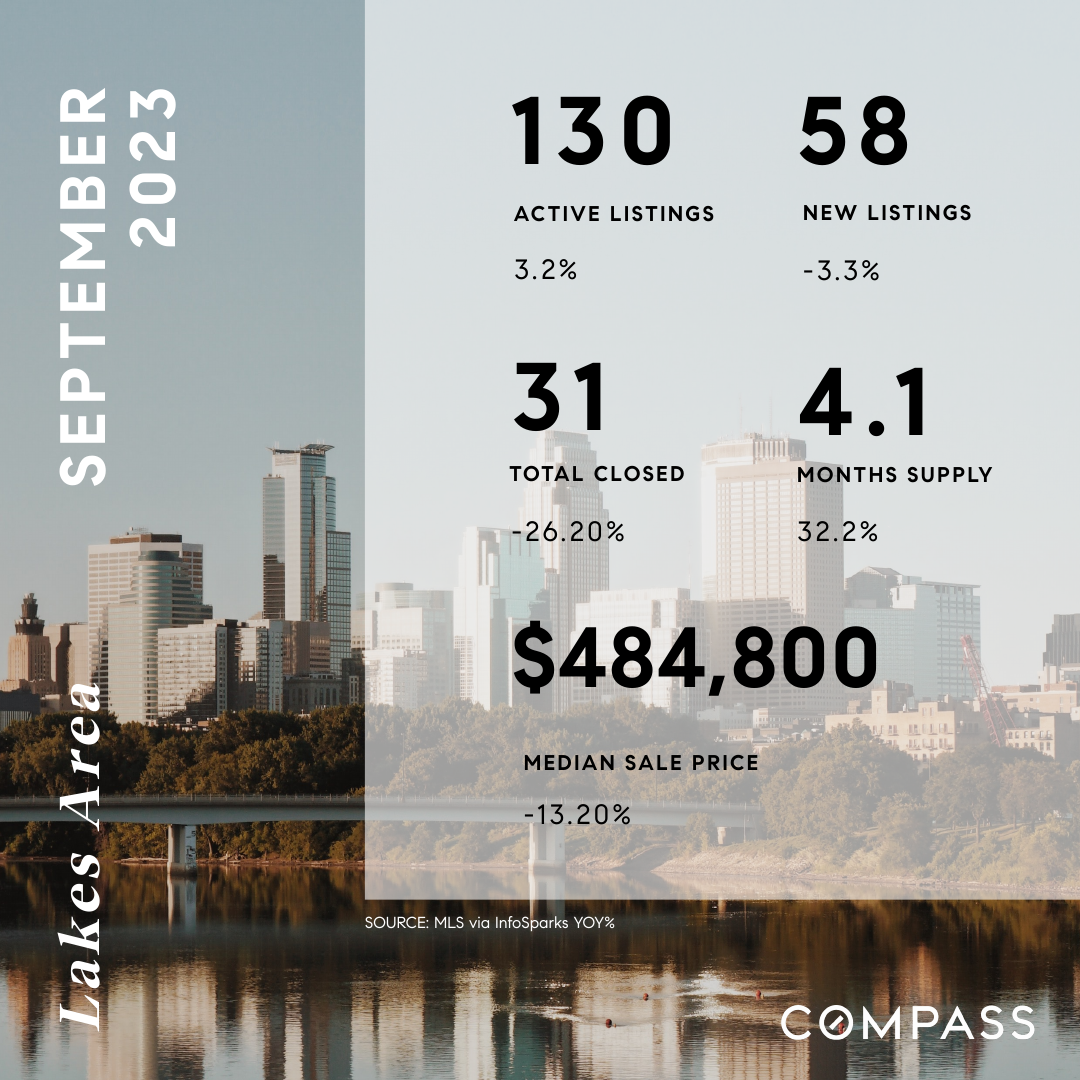

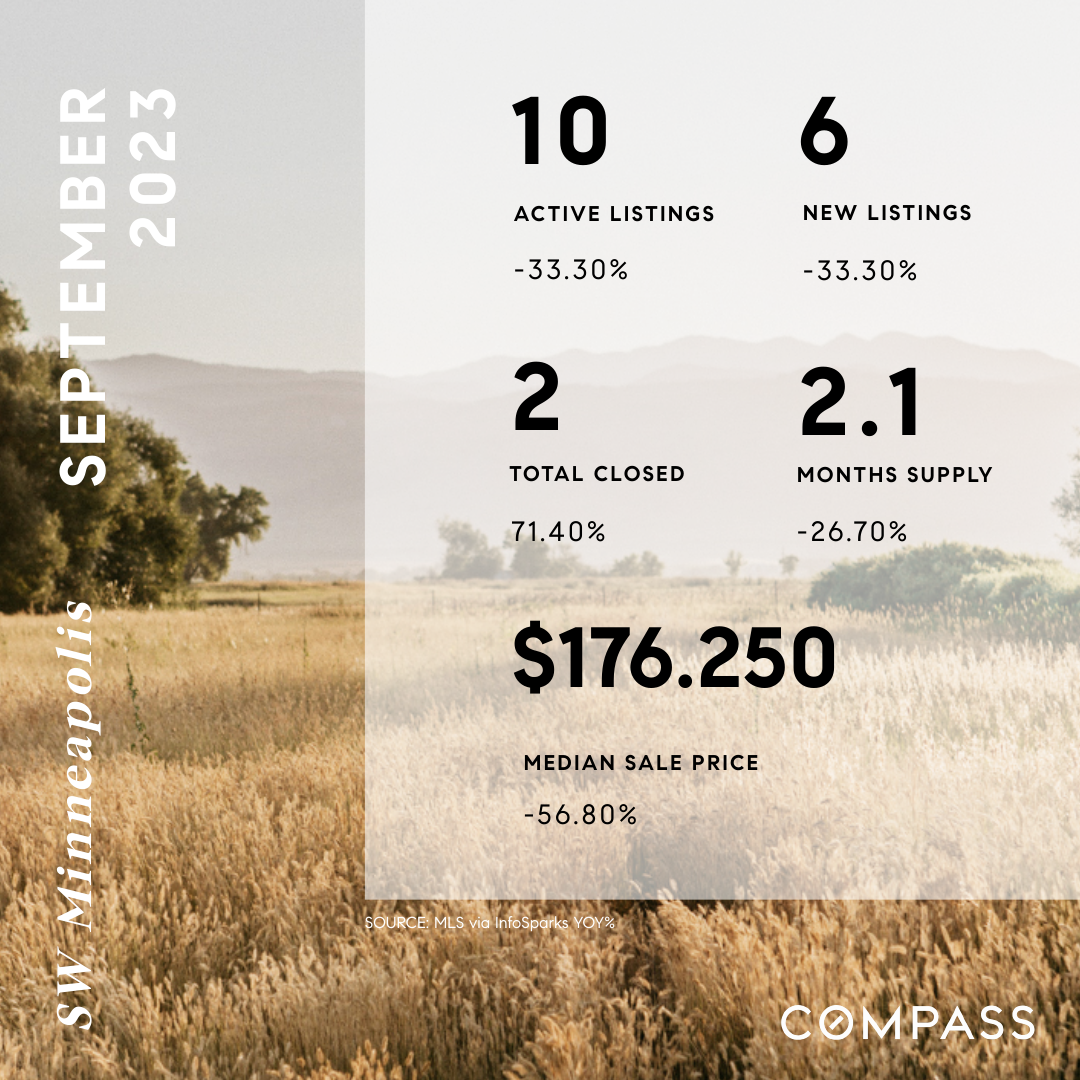

Data from Minnesota Realtors®: By MNR News (Oct. 16, 2023) – According to new data from Minnesota Realtors®, sales continued to soften in September, but home prices showed their largest year-over-year gain in over 12 months.

During the month of September, sellers listed 5.5% fewer homes than last year, leading to 2.9% fewer homes for sale across the state, further limiting buyer options. Many sellers who would ordinarily list homes—albeit fewer compared to the spring and summer markets—are staying put due to locking in a sub 4% rate. High mortgage rates on higher home prices are a double punch for buyers, and they're feeling the pinch at a time when their cost of living has increased. More so than prices, the budget footprint of the monthly mortgage payment is top of mind for many home buyers and sellers. That's one reason why closed sales were down 16.7% during the month. Yet, prices, market times, and negotiations still mostly favor sellers. The median home price rose 3.0%, the second-strongest growth rate since February of this year. Homes sold in 32 days, 3.0% slower than last September, and the only decline so far this year. Sellers are still getting 98.5% of their list price, up from last year. "One of the more puzzling pieces of today's market is how sales can slow as they have and yet prices remain firm," said Emily Green, President of Minnesota Realtors®. "While a few parts of the state and metro have seen sales softening, the fact that both buyer and seller activity have declined in tandem has kept the balance of the market fairly tight." In other words, since both supply and demand have declined, the balance between them hasn't changed as much as some real estate stakeholders expected. Some were expecting an increase in supply combined with a decrease in demand to result in price declines, which the data hasn't shown.

Insights and Anecdotes:

Agents across the state report that multiple-offer situations are less common compared to the last few years but are still occurring. Some properties are selling in a few days or even a few hours for well over the asking price. Overall, buyers are being more selective and cautious when choosing which listings to view and make offers on. With just 2.6 months of supply, it's still a seller's market, just not to the same degree as in the last few years. Typically, 4-6 months of supply are needed to have a balanced, neutral market.

Minnesota Economy:

Home sales and prices sometimes fluctuate with the business or interest rate cycle, but long-term, steady job growth with well-paying jobs is a key ingredient for a healthy and sustainable housing market. The state's unemployment rate is 3.1%, which is below the national average. Businesses are still having a hard time finding and retaining workers. Minnesota is fortunate to have a diverse economy spanning healthcare, finance and insurance, manufacturing, retail, professional services, as well as arts and entertainment. Building a sufficient number of homes to house workers across the spectrum has proven difficult. A few challenges facing our state (as well as others) include tax competitiveness, regulatory reform, environmental concerns, and addressing an aging population. While inflation has cooled notably from its peak, the rising cost of living is impacting Minnesotans in every neighborhood and zip code throughout the state.

As always, we are here if you ever have any questions or just want to chat about the right time that works for you to make the next move!